Risk allocation in long-term infrastructure projects

Lessons from the energy industry applicable to Carbon Removal

Executive Summary

The Carbon Dioxide Removal (CDR) industry stands at the forefront of our global efforts to combat climate change. As we work to meet ambitious climate targets, CDR technologies have emerged as a critical component in our strategy to reduce atmospheric carbon concentrations. These technologies, ranging from direct air capture to enhanced weathering, offer promising avenues for large-scale carbon sequestration.

While the energy transition is underway, oil and gas will continue to play a role in our energy mix in the coming years. As such, emissions reduction alone is no longer sufficient to address our climate challenges and we should apply the valuable lessons learned from decades of experience in the oil & gas and renewable energy industry.

My intention is to share some lessons I learned, sometimes the hard way, to help build bridges that can help the rapid and effective scaling of CDR technologies. I acknowledge the complexity of the topics, so I've decided to structure this information as a series of focused articles rather than a single, lengthy piece.

This approach allows us to dive deep into each crucial aspect of risk allocation in long-term infrastructure projects, applying lessons from the energy industry to CDR initiatives, without overwhelming the reader. By breaking down this complex topic into manageable segments, I hope to maintain your interest and provide opportunities for reflection between installments.

The series is structured as follows:

Part I: Common Risks in Long-Term Infrastructure Projects. Here we will delve into the most important (in my experience) risks inherent to large-scale infrastructure projects, including technical, financial and regulatory. Understanding these risks is crucial for both traditional energy projects and emerging CDR ones.

Part II: Traditional Risk Allocation Strategies in the energy industry. Here, we'll examine the time-tested strategies employed in the energy sector to manage and allocate risks. This will include an exploration of contractual mechanisms, insurance and hedging strategies, joint venture structures, and government support mechanisms.

Part III: Unique aspects of carbon removal projects and applying energy risk allocation lessons. This piece will highlight the distinct challenges faced by CDR projects, such as technological uncertainties and long-term storage liabilities. We'll then discuss how risk allocation strategies from the oil & gas and renewable energy industry can be adapted and applied to address these unique aspects of CDR initiatives.

Part IV: Emerging trends in risk allocation for carbon removal. The final article will look towards the future, exploring innovative approaches to risk allocation in the CDR industry. We'll examine performance-based contracts, the potential of blockchain technology, multi-stakeholder risk sharing models, and the role of green finance in supporting CDR projects.

By bridging the gap between established practices in the energy industry and the innovative world of carbon dioxide removal, this series aims to provide valuable insights for project developers, investors, policymakers, and other stakeholders in the CDR field. As we work towards a more sustainable future, effective risk management and allocation will be key to unlocking the full potential of CDR technologies.

Introduction

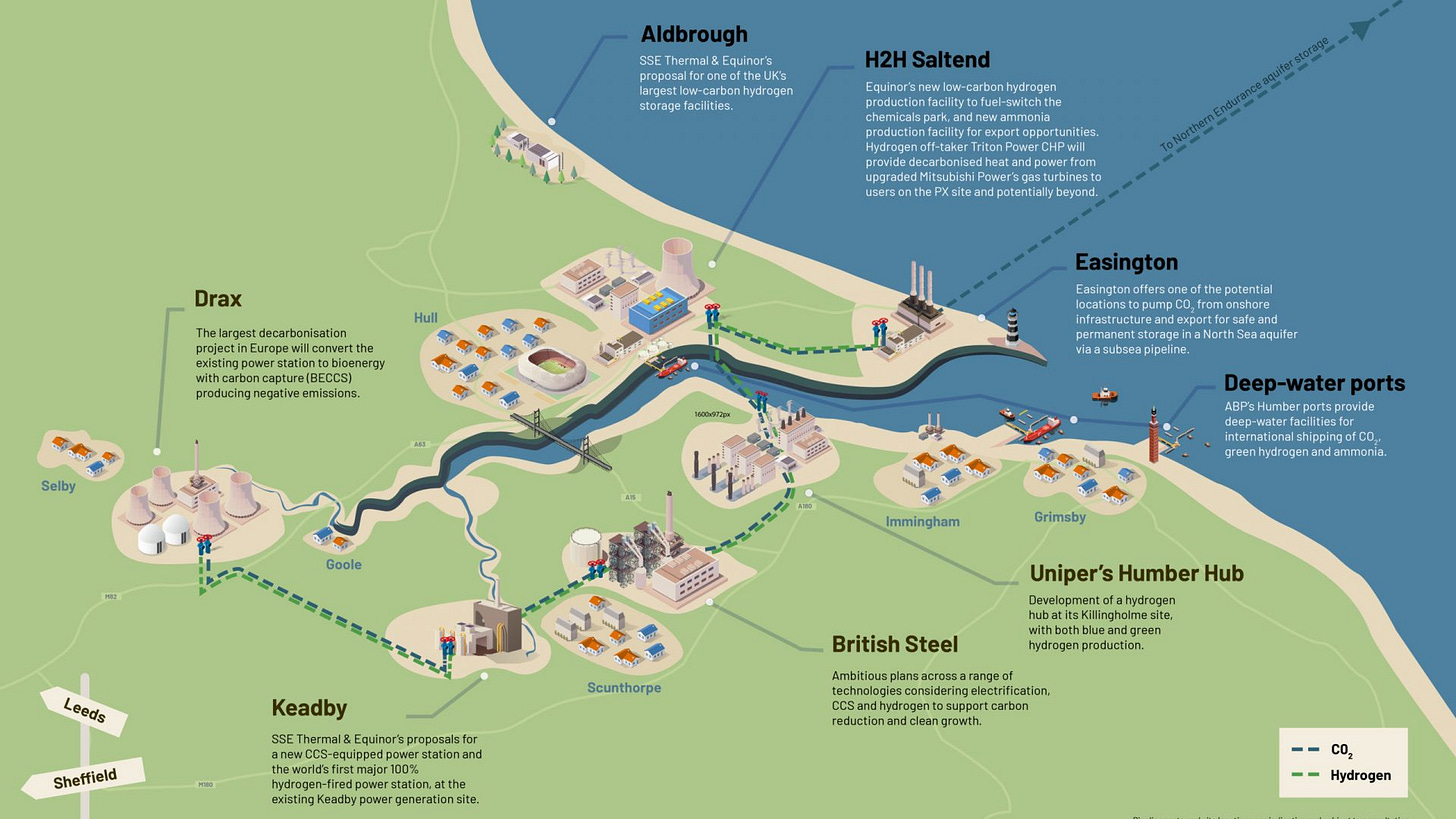

The CDR landscape is evolving very quickly, the complexity and scale of infrastructure projects1 underscore the critical importance of effective risk allocation. In innovative infrastructure projects like Direct Air Capture (DAC) or Bioenergy with Carbon Capture and Storage (BECCS), the stakes become exceptionally high.

Consider the immense scope of these projects: DAC facilities require vast air contactor units, advanced processing facilities, and substantial energy infrastructure; BECCS demands extensive biomass cultivation areas, sophisticated processing plants, and integrated carbon capture systems. Each of these approaches represents a monumental undertaking, filled with diverse and significant risks2.

Source: Drax3

In this context, the systematic distribution of project risks among stakeholders becomes the cornerstone of success. As contractors and potential partners embark on these massive endeavors, determining who assumes which risks, when, and how is fundamental to be clear from the outset.

Early agreement on risk allocation sets the tone for the entire joint venture relationship, influencing everything from project financing to day-to-day operations. Partners who successfully navigate this crucial phase of position themselves to create a balanced, sustainable partnership capable of withstanding the inevitable challenges of large-scale infrastructure development.

Clearly defining risk responsibilities, partners lay a solid foundation for their project, optimizing efficiency, minimizing overall costs, and significantly enhancing the project's chances of success. The intention is always to make sure that each risk is assigned to the party best equipped to manage, mitigate, or bear it, creating a framework for cooperation, innovation and progress.

As the CDR industry continues to grow and evolve, effective risk allocation strategies will play an increasingly vital role in driving successful collaborations. I’ve gathered some of the risks I’ve stumbled upon during my career as a joint venture negotiator for large infrastructure energy projects in the Gulf of Mexico and the North Sea which I believe are transferable to the CDR industry.

Carefully defining the risks and the strategies to mitigate them will not only facilitate the development of groundbreaking projects but also contribute to the broader goal of combating climate change through large-scale carbon removal initiatives.

Common risks in long-term infrastructure projects

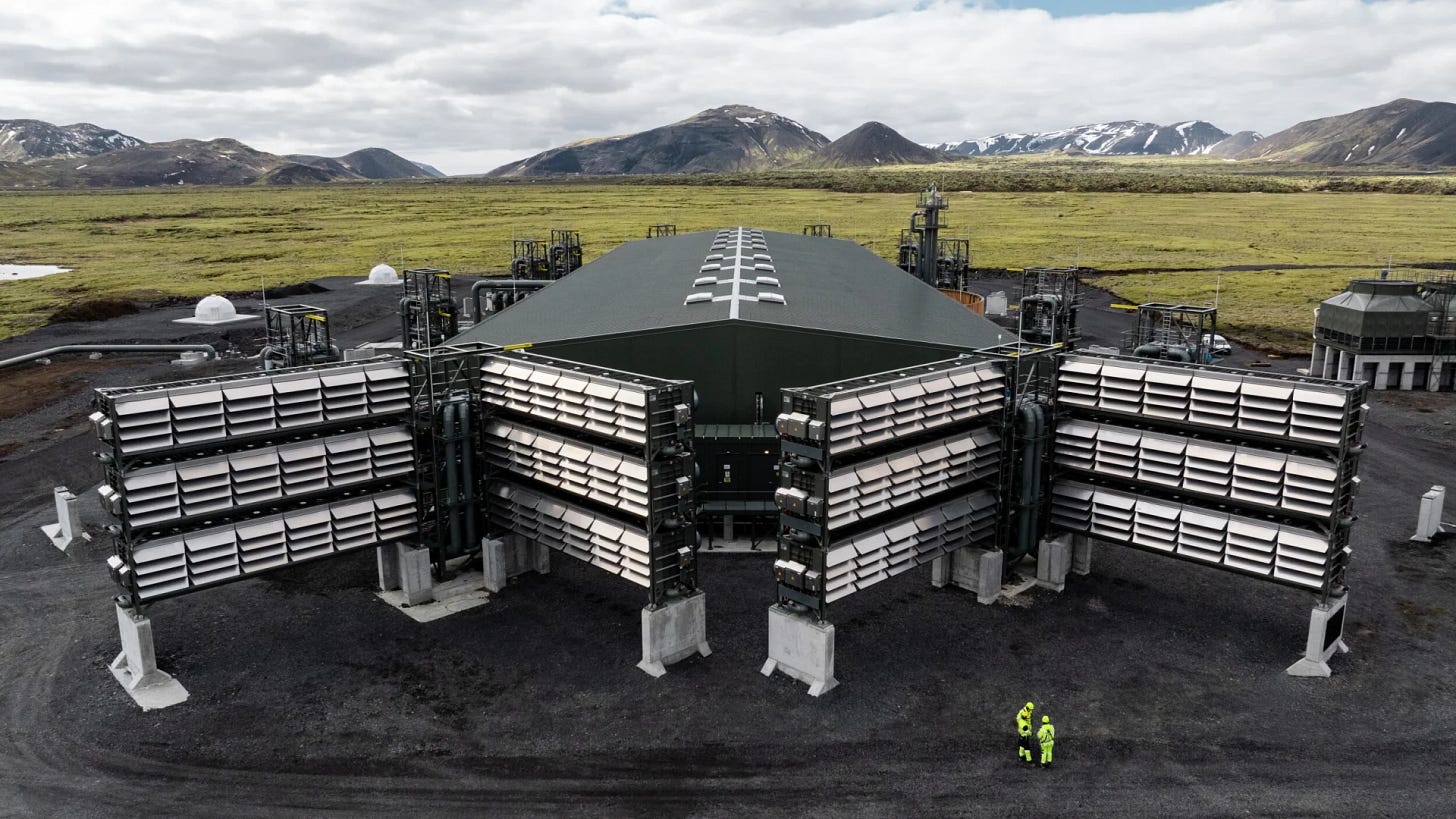

Mammoth Direct Air capture facility in Iceland. Source: Climeworks4

Effective risk management isn't just a best practice—it's a necessity. Long term infrastructure projects involve high-stakes with significant technical, financial and market implications.

At its core, risk allocation It's a delicate balancing act that can make or break a project. Over the years, I've seen the effects of poor risk allocation and how proper risk distribution can streamline operations, reduce costs, and ultimately determine a venture's viability.

Let's identify these common risks first in order to understand them as this will help us later to discuss how proper management can turn potential pitfalls into opportunities.

Technical Risks: The Project's Achilles Heel

Technical risks are the engineering and operational uncertainties that can derail a project's timeline and budget. They include:

Design Flaws: Errors in project design leading to performance issues or safety concerns. Example: A North Sea oil platform where a miscalculation in load-bearing capacity needed a costly redesign mid-construction, delayed the project by 18 months.

Construction Challenges: Unforeseen site conditions or technical complexities during building. Example: In a Gulf of Mexico drilling project, unexpected geological formations required specialized (unforeseen) equipment, inflating costs by 32%.

Operational Performance: Failure to meet expected standards or efficiency targets. Example: A natural gas processing plant consistently underperformed, operating at 75% of projected capacity due to integration issues between key components.

Proactive management of these risks is crucial. In a joint venture for a large-scale methanol production facility in Europe, we implemented a phased design review process. This approach involved detailed risk assessments at each project phase and allowed us to identify and mitigate potential issues early. As a result, we reduced overall project costs by 20% and avoided significant schedule delays.

Financial Risks: Navigating the Money Maze

Financial risks can significantly impact a project's economic viability. Key concerns include:

Cost Overruns: Expenses exceeding initial budgets. Example: An LNG terminal project I worked on saw costs increase by 30% due to material price spikes and labor shortages.

Funding Shortfalls: Challenges in securing or maintaining necessary financing. Example: A midstream pipeline project faced a funding gap when a key investor pulled out, requiring a complex restructuring of the partnership agreement.

Market Risks: Volatility in commodity prices or demand fluctuations. Example: An offshore wind project's economics were severely disrupted by unexpected drops in energy prices, this dramatic shift called for a renegotiation of power purchase agreements to ensure the project’s economic viability.

Effective financial risk management often involves creative structuring. A couple of years back when negotiating a long-term natural gas supply agreement, we implemented a pricing formula tied to a basket of energy indices, providing a hedge against price volatility in any single market.

Regulatory and Political Risks: The Shifting Sands

LNG Terminal. Source: GreenOak/Shutterstock.

The regulatory landscape for energy projects has always been dynamic, with constant evolution in policies and regulations. As we look to apply lessons from the energy sector to the emerging field of CDR, it's clear that these challenges will be equally, if not more, prevalent. Key risks include:

Policy Shifts: Changes in government stance or regulations. Example: A cross-border pipeline project faced significant delays when one country unexpectedly intensified its environmental regulations.

Permit Delays: Prolonged approval processes impacting project timelines. Example: An offshore wind farm project in the North Sea faced an 18-month delay due to evolving environmental impact assessment requirements under the EU's Renewable Energy Directive.

Contract Renegotiations: Government-initiated changes to project terms. Example: A long-term oil production agreement had to be renegotiated mid-project when the host country changed its energy policy.

Cultural Risks: The Invisible Deal-Breakers

Negotiating international energy partnerships, I've learned that cultural factors can be as critical as financial or technical considerations. These risks, often underestimated, can significantly impact project success, particularly when dealing with cross-border collaborations. Key aspects include:

Communication Barriers: Misunderstandings arising from language differences or communication styles. Example: In a joint venture between an international joint venture and a national oil company, initial negotiations stalled due to different expectations about directness in communication.

Decision-Making Processes: Variations in hierarchical structures and decision-making norms. Example: A US-based energy firm's fast-paced decision-making clashed with the consensus-driven approach of their European partners.

Local Customs and Practices: Misalignment with local business etiquette and social norms. Example: A US-energy firm faced resistance when engaging with regulators and government officials as its approach was only money driven, disregarding the fact that stakeholders where more interested in energy security and protecting the country’s national resources.

Relationship Building: Underestimating the importance of personal relationships in business dealings. Example: In a South American hydroelectric project, initial distrust between foreign investors and local authorities was overcome by organizing informal social events.

Mitigating cultural risks requires a proactive and respectful approach. I was involved in a wind farm project in the North Sea involving partners from three different countries where I had to implement a comprehensive cultural integration program. This included cross-cultural training, regular team-building exercises, and the establishment of a diverse project management office. The result was increased partner satisfaction and a significant reduction in dispute-related project delays.

Successful navigation of cultural risks goes beyond mere awareness—it requires genuine respect, open-mindedness, and a willingness to adapt. As we look to apply these lessons to the emerging CDR sector, the ability to bridge cultural divides will be crucial in forging the international collaborations necessary to tackle global climate challenges.

Conclusion

We've explored what I believe are the key risks inherent in large-scale infrastructure projects from technical and financial to regulatory and cultural. While this list is by no means exhaustive, it represents the critical challenges that, in my experience, can make or break a project. It's clear that the energy industry has developed a robust toolkit for risk management which offer invaluable insights for the emerging CDR sector.

The CDR industry, while pioneering in its goals, faces many of the same fundamental challenges we've dealt with in oil, gas and power projects. CDR projects can potentially leapfrog many of the pitfalls that have historically challenged large infrastructure initiatives by understanding and adapting the risk management strategies developed in the energy industry. This transfer of knowledge and experience is crucial not just for the success of individual CDR projects, but for the rapid scaling of the entire sector – a necessity if we are to meet our global climate goals.

In the next part of this series, we'll delve deeper into the specific strategies that the energy industry has honed over decades to manage and allocate these risks effectively. We'll examine, contractual mechanisms, hedging strategies, joint venture structures and government support mechanisms.

Each of these strategies has been refined through countless energy projects across the globe. By exploring them in detail, my intention is to provide a roadmap for CDR practitioners to adapt ceteris paribus and apply these proven methods to their unique challenges.

The successful scaling of CDR technologies is vital to our global climate efforts and by learning from the past and adapting to the future, we can build a more resilient, effective approach to tackling one of the most pressing challenges of our time.

Join me in the next part of the series as we unpack these strategies and explore their potential applications in the CDR landscape.

Various reports highlight the massive scale-up required for Carbon Dioxide Removal (CDR) to meet climate goals. The 2024 State of CDR report indicates a need for 7-9 billion tonnes of CO2 removal annually by mid-century, compared to current levels of about 2 billion tonnes, mostly through conventional methods. Industry analyses (BCG, McKinsey) suggest that novel CDR methods need to increase by factors of 30 to 540 by 2030 to be on track. This scale-up necessitates significant infrastructure development, including geologic sequestration facilities and CO2 transport systems, with potential annual revenues reaching $0.3-$1.2 trillion by 2050. The infrastructure requirements for effective CDR are comparable to those of major global industries, demanding substantial investment and collaboration across sectors.

While DAC and BECCS, are prominent CDR approaches, other methods also require significant infrastructure. Ocean Alkalinity Enhancement relies on specialized ships, coastal processing facilities, and expansive mineral mining operations. Enhanced weathering involves large-scale mineral extraction, grinding, and distribution operations. Soil carbon sequestration requires widespread changes in agricultural practices and potentially specialized equipment for biochar production and application. Afforestation and reforestation require extensive land management systems and potentially irrigation infrastructure in certain regions. Coastal blue carbon projects may need specialized equipment for mangrove or seagrass restoration. Each method presents unique infrastructure challenges, from transportation networks to monitoring systems, underlining the complexity and scale of comprehensive CDR deployment.

https://www.drax.com/about-us/our-projects/bioenergy-carbon-capture-use-and-storage-beccs/

https://climeworks.com/press-release/climeworks-switches-on-worlds-largest-direct-air-capture-plant-mammoth