Risks Allocation in Large Infrastructure Projects (Part II)

Traditional Risk Allocation Strategies in the Energy Industry

In Part I of this series, we explored the common risks inherent to long-term infrastructure projects focusing on the energy sector. We explored technical risks that can derail project timelines and budgets, financial risks that threaten economic viability, regulatory and political risks that shift the ground beneath our feet, and cultural risks that can silently undermine international collaborations. These risks are not merely theoretical concerns but tangible challenges that I've encountered throughout my career negotiating complex energy projects across the globe.

In the high-stakes world of energy infrastructure, where capital investments often run into billions of dollars and project life spans stretch across decades, risk allocation is a delicate balancing act that requires a deep understanding of not only the risks themselves but also the capabilities, risk appetites, and strategic objectives of all parties involved.

In this second part of our series, we'll explore these traditional risk allocation strategies in depth. We'll examine contractual mechanisms from Engineering, Procurement, and Construction (EPC) contracts to Power Purchase Agreements (PPAs).

These strategies, while developed primarily in the context of traditional energy projects, offer invaluable insights for the emerging field of Carbon Dioxide Removal (CDR). As we progress through this exploration, we'll begin to see how these time-tested approaches can be adapted and applied to the unique challenges faced by CDR initiatives.

Understanding traditional risk allocation strategies can help stakeholders in both conventional energy projects and innovative CDR ventures to be better equipped to navigate the complex risk landscape, fostering resilient partnerships and driving forward the critical infrastructure needed to meet our global energy and climate challenges.

Join me as we unpack these strategies, drawing on real-world examples and hard-won insights from negotiating tables across the energy spectrum.

Contractual Mechanisms

Engineering, Procurement, and Construction (EPC) Contracts.

EPCs are very lengthy and comprehensive agreements where a contractor is responsible for all aspects of project delivery, from design to construction and commissioning. These agreements provide a single point of responsibility, reducing project management complexity for the owner. These contracts form the backbone of large-scale infrastructure projects, from offshore oil platforms to wind farms. To me the key Characteristics of EPC Contracts are:

Turnkey Nature: The turnkey approach ensures that a project is delivered as a fully operational facility, ready to run with just the "turn of a key." Tip: while turnkey delivery can seem ideal, it's crucial to define what "fully operational" truly entails. In a wind farm case in the North Sea, it was essential to include specific performance metrics, such as power output under various wind conditions, to ensure the project met its intended goals.

Single Point of Responsibility: In a turnkey contract, the contractor takes on the responsibility of managing all aspects of the project, which significantly simplifies project management for the owner. Tip: it’s important to maintain visibility into critical subcontractors- I’d recommend negotiating step-in rights for key subcontracts, to allow the owner to intervene if necessary.

Fixed price and timeline: provides greater cost certainty and reduces financial risks for the project owner. This has been particularly beneficial in large-scale projects like LNG terminals, where predictability is critical. Tip: To address project cost increases in LNG projects, change order procedures and cost monitoring process should be clearly defined and negotiated.

Fixed Completion Date: These contracts include a guaranteed completion date, either as a fixed date or a fixed period after commencement. If this date is not met, the contractor is usually liable for liquidated damages

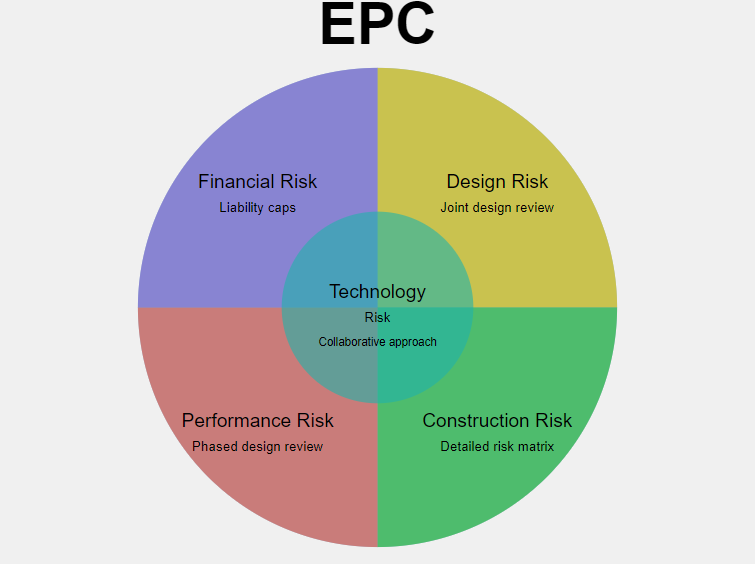

Now, risk in turnkey contracts should be allocated to the party best equipped to manage it, ensuring a balance between accountability and practicality. Now what are the most important risk to assign and to who? Lets see:

Design, the contractor usually assumes full responsibility for design, including any errors or omissions. However, in cutting-edge projects, it might be more prudent to share this risk. For example, in my first ever floating offshore wind project, we implemented a joint design review process where both the contractor and the owner shared responsibility for innovations. This collaborative approach allowed for better risk management and design optimization.

Construction, the contractor usually bears the risk of delays and defects during construction. In a recent floating LNG project, we developed a detailed risk matrix to clearly outline these responsibilities. Tip: To mitigate construction risks, it’s also important to account for force majeure events. Hurricane caused delays urged the offshore industry to start incorporating detailed weather-related provisions in all offshore contracts to better protect against such disruptions.

Performance, the contractor is responsible for ensuring that the project meets the specified performance levels. In a methanol production facility in Europe, we mitigated this risk by implementing a phased design review process. By evaluating performance at various stages, we were able to anticipate and address issues proactively. Tip: You might want to link performance guarantees to liquidated damages, but you need to maintain the project’s bankability, so make sure these are capped.

Financial, while the contractor typically assumes financial risk for cost overruns, more nuanced approaches are emerging. In a recent offshore wind project, we negotiated liability caps to make the project more bankable, ensuring the contractor wasn’t overburdened with risk. Tip: For large-scale projects, consider parent company guarantees, as they can play a pivotal role in securing financial close and protecting against potential financial shortfalls.

What can we learn from energy EPCs in CDR Projects?

Flexible Performance Metrics: Given the nascent stage of many CDR technologies, performance guarantees need to be flexible and evolve as the project scales up.

Collaborative Design Process: Implement a joint design review process to leverage both the contractor's expertise and the owner's technology knowledge.

Phased Commissioning: For large CDR projects, consider a phased approach to commissioning, allowing for learning and adjustment as each phase comes online.

Regulatory Adaptation Clauses: Include specific provisions for adapting to changes in carbon credit regulations or measurement standards.

EPC contracts have evolved from simple construction agreements into sophisticated risk management tools. Their application in the CDR industry represents a critical transfer of knowledge from traditional energy projects to the technologies shaping our low-carbon future.

As we navigate the construction of CDR infrastructure, the ability to craft EPC contracts that balance risk, innovation, and bankability will be more crucial than ever.

Power Purchase Agreements (PPAs)

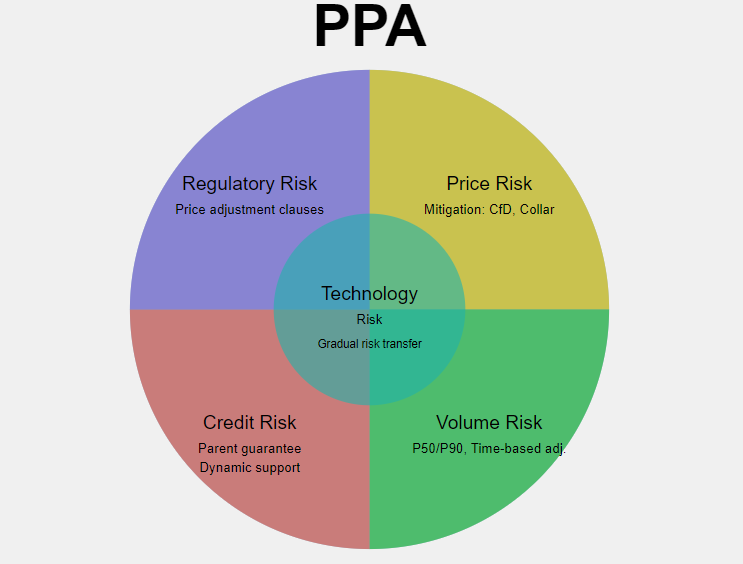

PPAs are long-term contracts between energy producers and buyers that specify the terms of electricity sales including (most importantly) pricing and volume. They provide revenue certainty for producers and price stability for buyers, making projects bankable and facilitating the energy transition. Let's dive into the key characteristics of modern PPAs:

Long-term Commitment: when entering into a long-term PPA it's important to balance stability with adaptability. For example, in a UK offshore wind PPA, we built in re-opener clauses1 every five years to adjust for significant market shifts. This flexibility allowed us to maintain long-term certainty while ensuring the contract could evolve with changing conditions.

Pricing Mechanisms: Modern PPAs have evolved beyond simple fixed-price agreements to incorporate sophisticated pricing mechanisms as a way to adapt to market dynamics. In solar projects, I’ve seen PPA prices linked to both the consumer price index and natural gas prices. Tip: It's essential to manage pricing risks carefully, to mitigate volatility try to cap the price of the commodity component (in this case gas) to protect the project from extreme fluctuations in energy prices and maintain a fair and balanced pricing structure.

Volume Commitments: In PPAs for emerging technologies or new facilities, volume commitments often require a flexible approach to accommodate production uncertainties and growth phases. Green hydrogen facilities are a clear example, these projects usually require structured purchase obligations on a sliding scale as production ramps up. This flexibility allows for smoother growth and operational alignment.

So how is risk allocated in PPAs? Well, it is similar to EPCs in the way that it aims to assign risks to the party best equipped to manage them. However, PPAs deal with long-term operational and market risks rather than construction risks, so there are important other risks to consider. Let's see:

Price, to manage price risk, I've used Contracts for Difference2 structures, where two-way payments are based on market price variations. Tip: To mitigate price risks, consider collar structures3. In a solar PPA, we implemented a collar with a 'shared upside' mechanism. This provided downside protection while allowing for some profit sharing when prices exceeded the ceiling.

Volume, North Sea wind PPAs, use a "P50"4 production baseline, with the producer bearing the risk for variations up to a P90 threshold. This means, basically, the energy producer is responsible for compensating the buyer for any production shortfall between the expected average (P50) and the more conservative estimate (P90).Beyond that, risks were shared between the parties. Tip: To further mitigate volume risks, we included time-based adjustments for volume commitments, taking seasonal and time-of-day factors into account for a more accurate P50 calculation.

Credit, to mitigate long-term credit risk a parent company guarantee is usually a good idea. Tip: For long-term PPAs, dynamic credit support mechanisms can be beneficial. In one instance, we linked the required credit support to the off-taker's credit rating, adjusting the level of support annually to align with their financial standing.

Regulatory, can be addressed by incorporating price adjustment clauses for material adverse adverse changes in renewable support schemes. Tip: Its essential to clearly define what constitutes a 'material adverse change' specifying which regulatory shifts would trigger adjustments to avoid potential disputes.

Technology, for new technologies, shared technology risk provisions can be effective. In a floating offshore wind project, we structured the risk transfer to occur gradually. The project company retained more risk during the first two years of operation, only transferring it to the off-taker once performance was proven.

What can we learn from PPAs in CDR Projects?

Flexible Volume Commitments: Given the nascent stage of many CDR technologies, consider more flexible volume commitments that increase over time as technology improves and scales.

Carbon Credit Ownership: Clearly define ownership and trading rights for carbon credits generated by the project. This is crucial as carbon markets mature.

Monitoring and Verification: Include detailed provisions for how carbon removal will be measured and verified, possibly referencing emerging industry standards.

Regulatory Adaptation: Build in mechanisms to adapt to evolving CDR regulations and carbon pricing schemes, which are likely to change significantly over the life of the project.

Multi-buyer Structures: Consider aggregating demand from multiple buyers to reduce off-take risk.

PPAs have evolved into sophisticated risk management tools crucial for project finance and operations. As we tackle climate change, the lessons learned from energy PPAs are proving invaluable in structuring agreements for emerging technologies like CDR.

C. Joint Operating Agreements (JOAs)

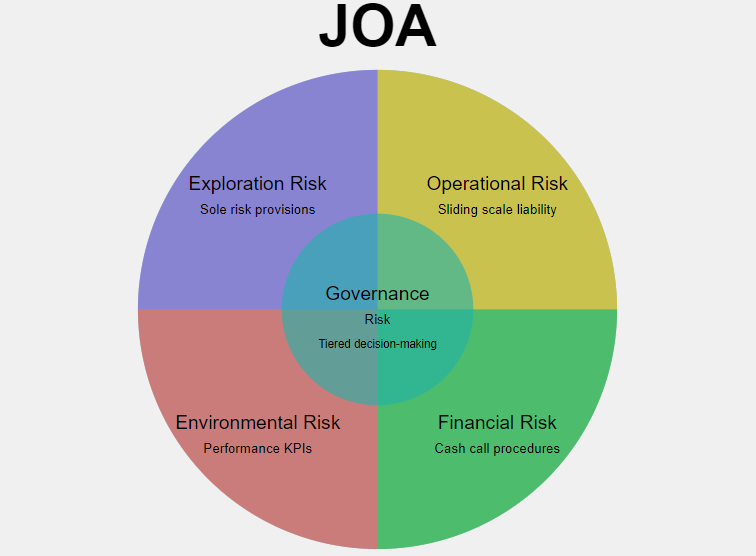

A Joint Operating Agreement is a contract between two or more parties that outlines the terms and conditions for jointly exploring, developing, and producing oil, gas, or other energy resources from a specific area or project. JOAs are commonly used in oil and gas exploration and production where risks are high and need to be shared between partners. Key characteristics include:

Decision making: in a joint venture this is key to allow partners to be involved in the important activities of the venture without interfering in day to day operations. In an oil exploration project, we implemented a tiered decision-making structure within the Operating Committee (OpCom), using different voting thresholds for different types of activities to balance efficiency and minority protection. For routine operations, decisions were made by a simple majority (519, but strategic matters required a supermajority (90%)5.

Default provisions: it is key to understand what happens when a party does not meet its main obligations and what to do to inhibit defaulting behavior. Usually you set a 30-day grace period for missed payments, which can then be followed by a three-tier remedy system—interest charges, loss of voting rights, and forced dilution. These provisions are tailored to the project phase, with leniency applied during the exploration phase and stricter consequences during production.

Operator rights and duties: Too much authority for the operator and it might abuse its role, too little and it might be cumbersome to carry out day to day operations, the idea is to strike the right balance. In a Gulf of Mexico deepwater exploration project the operator was required to perform "in accordance with industry best practices" under a tiered decision-making matrix tied to expenditure levels. Provisions for operator removal were included but set at a high threshold, requiring a 85% vote and proof of gross negligence/will full misconduct.

Exit strategies: these help determining when a party has the right to pull out of the venture and I find it crucial for any joint venture negotiation. You don’t want to be stuck with the wrong partner in the right project. A common right is the Right of First Refusal (ROFR) to give existing partners priority when another partner wants to sell its participating interest. Provisions for IPOs or change of control events need to be negotiated, as in an Gulf of Mexico project, where we included clauses on how the JOA would adapt if a partner went public or was acquired.

JOAs deal with shared operational risks and rewards among multiple parties over extended periods of time. This introduces critical considerations. Let's examine the key risk allocation aspects in JOAs:

Operational, In a Gulf of Mexico shallow-water project, we negotiated shared operational risk using a sliding scale of operator liability. The operator's liability increased in proportion to the level of control exercised, incentivizing good management while ensuring non-operators had meaningful input.

Financial risks are typically proportional to ownership interests, but in an African oil project, I’ve seen mitigated cash flow issues by implementing cash call procedures with a built-in two-month operating cost buffer for partners.

Environmental and safety risks are often shared, with the operator responsible for implementing programs. In a North Sea wind farm JOA, we introduced specific KPIs for environmental performance, where failure to meet them triggered a review of the operator’s role, ensuring a continued focus on environmental standards while keeping operator accountable.

Exploration risks are usually shared but addressed through sole risk provisions. For example, in a Gulf of Mexico exploration JOA, we developed a detailed procedure for sole risk operations, including a "sliding scale" that allowed non-participating parties to buy back in, balancing individual rewards with long-term project cohesion.

What can we learn from JOAs for CDR Projects?

Share risk and rewards: sharing risks and rewards among partners is essential, drawing from principles found in JOAs. Financial risks, such as the capital expenditure for infrastructure and technology and the operational costs for maintenance and monitoring, should be shared proportionally according to each partner's stake in the project. Similarly, technology risks, including the possibility of underperformance or failure, should be jointly borne by all parties. Initially, it might be prudent for technology providers to assume a larger share of this risk, with the burden gradually shifting to equal sharing as the technology proves its reliability.

Governance: Consider creating specialized committees with delegated authority to quickly adapt to technological or regulatory changes.

Performance-Based Operator Incentives: Tie operator compensation to key CDR metrics like capture efficiency and storage permanence. This aligns incentives and drives innovation.

Staged Risk Allocation: For new CDR technologies, consider a phased approach to risk allocation. Start with more risk held by the technology provider, gradually transitioning to the operator as performance is proven.

Robust Reporting and Verification: Include detailed protocols for measuring, reporting, and verifying carbon removal. This is crucial for credibility and potential monetization through carbon markets.

In conclusion, while JOAs will need tailoring for CDR projects, the core principles of clear governance, fair risk allocation, and adaptability remain crucial. As we tackle climate change, the ability to craft JOAs that balance certainty with flexibility, and familiar risks with emerging challenges, will be key to scaling up carbon removal efforts globally.

Conclusion

Throughout this second part of our series, we've explored traditional risk allocation strategies employed in the energy sector, focusing on contractual mechanisms. We've examined the intricacies of EPCs contracts, PPAs, and JOAs, unpacking how these time-tested mechanisms distribute risk among project stakeholders.

As we've explored these traditional approaches, we've also begun to draw parallels to the emerging field of Carbon Dioxide Removal (CDR). The lessons learned from energy projects - be it in flexible performance metrics, adaptive pricing mechanisms, or tiered decision-making structures - offer valuable insights that can be applied and adapted to the unique challenges of CDR initiatives.

As we move into the third part of our series, we will shift our focus more directly to the world of Carbon Dioxide Removal. While the fundamental principles of risk allocation remain relevant, CDR projects present a unique set of challenges that require innovative thinking and adaptations of traditional strategies.

In the next article, we will explore the distinct characteristics of CDR projects that set them apart from traditional energy infrastructure, how the lessons learned from energy risk allocation can be applied to these unique aspects of CDR initiatives and the new risks that emerge in CDR projects, such as permanence risk in carbon storage, and how these can be managed using adapted versions of traditional risk allocation tools.

By bridging the gap between established energy industry practices and the world of carbon dioxide removal, my purpose is to provide a roadmap for effectively managing and allocating risks in this crucial emerging field. Join me as we continue to explore and build a more sustainable future.

A reopener clause is a provision in a contract that allows for the renegotiation of specific terms under predefined conditions. It provides flexibility to address unforeseen changes, such as shifts in economic factors or significant risks, without terminating the entire agreement, ensuring the contract remains fair and viable over its term.

Contracts for Difference (CfDs) are financial mechanisms used to stabilize prices in the energy industry, particularly for renewable projects. They set a fixed "strike price" for electricity, guaranteeing revenue for generators and protecting consumers from price volatility. In the carbon dioxide removal (CDR) industry, CfDs could similarly ensure price stability, incentivize investment, and support the development of new technologies by providing long-term financial certainty.

A collar structure is a risk management strategy used in energy markets to protect against price fluctuations.

Imagine you run a small manufacturing company that relies heavily on natural gas for production. Your profitability is significantly impacted by natural gas prices, so you want to manage this risk. By using a collar structure work like this: (i) you secure an agreement that guarantees you can sell your products at a minimum price, even if natural gas prices fall dramatically; (ii) in exchange for this protection, you agree to cap your potential gains if natural gas prices rise substantially. This balance often allows you to implement this strategy at low or no upfront cost. The benefits are that you operate within a known price range, enhancing budget forecasting, you are protected against severe market downturns; and these are often structured to minimize or eliminate upfront costs.

In essence, a collar structure in energy markets allows companies to navigate price volatility by sacrificing some potential for exceptional gains in exchange for protection against significant losses.

Energy contracts often use a risk-sharing model based on production estimates: P50 Baseline is used to determine the expected average production level meaning there is a 50% chance of producing more and 50% chance of producing less. A P90 threshold is a more conservative estimate, meaning there is a 90% chance of producing at least this much

If a Contract is based on P50 production, the producer is responsible for shortfalls between P50 and P90 and any risks beyond P90 are typically shared.

The practical implications of a supermajority requirement can vary significantly depending on the number of parties involved and their respective ownership stakes. For instance:

In a two-party joint venture with a 60%-40% ownership split, a 90% supermajority effectively requires unanimity, as neither party can reach the threshold without the other's agreement.

In contrast, in a four-party joint venture with ownership stakes of 30%, 15%, 15%, and 40%, a 90% supermajority could be achieved with the agreement of just two parties (e.g., the 30% and 40% stakeholders), or it might require the agreement of three parties, depending on the specific combination.

The choice of supermajority threshold should be carefully considered to balance the need for consensus on critical decisions with the practical ability to make decisions efficiently. Partners should also consider including provisions for deadlock breaking mechanisms in cases where the supermajority threshold cannot be met.